Step Inside The Market

- James Fasola

- Jun 27, 2024

- 4 min read

When we look back at the first half of 2024, it's easy to see that the market is still in a funk from the craziness of 2020-2022. Here are three main reasons to think about:

Interest rates and where we could go from here 🚀

High home prices and housing stock stagnation 📈

The rise of the Renter Market 🤝

Interest Rates

Since the beginning of the year, we have seen the continued pressure that high (and still rising) interest rates have had on the market. For the average 30 year fixed loan, rates have increased from 6.6% to 6.95% as of June 13th. For context, rates are higher today than at the same period last year, when average rates were at 6.88%.

However, we have seen a bit of relief over the last month, with rates decreasing from the peak of 7.22% in early May, which has spiked mortgage application growth!

"Well back in my day, we had high interest rates as well! "

While folks from the Baby Boomer generation are right that interest rates have been higher in the past, there are more market factors at play which are making homeownership difficult for many Americans. If we zoom out and look at historical interest rate averages, we are looking at a bleak picture, with mortgage rates at highs we haven’t seen since 2005, when the median home price was $232,500 compared to $420,000+ in 2024. These factors along with household income underperforming inflation over the last 40 years, has led to an affordability crisis for many Americans.

🆘 Is relief on the way?!?

The FED Board has let us know that they are not lowering rates anytime soon and we may only see one rate decrease in 2024. While this news is not a crystal ball forecast, it does give us some insight into what may come, and it doesn’t look like we will have much assistance with lower interest rates in 2024, even with the upcoming elections!

High home prices and housing stock stagnation

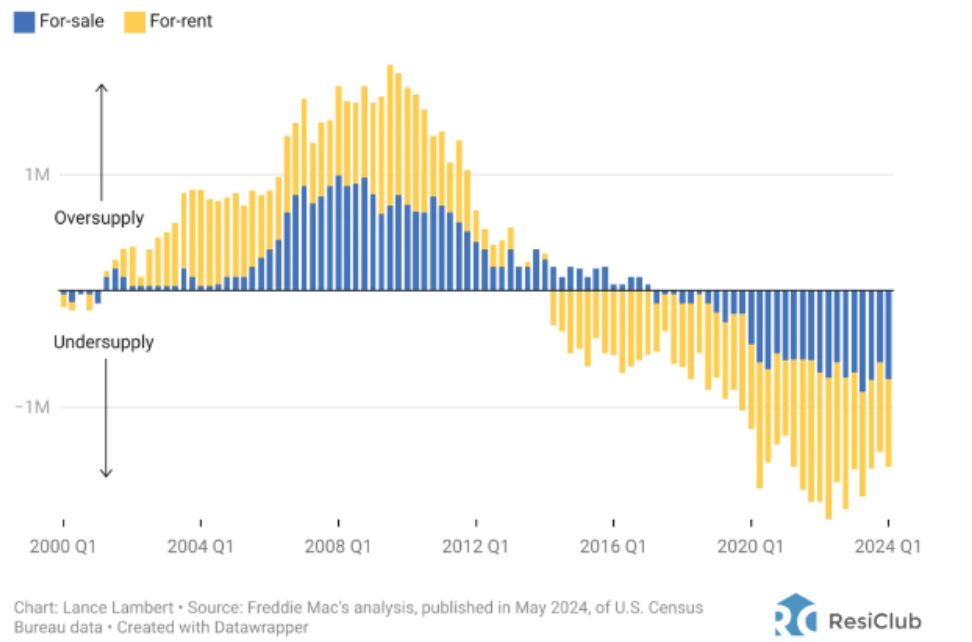

As more and more Millennials and Gen Zer’s enter the housing market, we are seeing the strain of higher demand against the backdrop of low inventory. According to Freddie Mac Economists, the U.S. housing market is short at least 760,000 for-sale housing units and short another 760,000 for-rent housing units, which means the U.S is 1.5 Million units away from a balanced market.

It’s also important to note that Freddie Mac believes this is a significant underestimate of the total need, which could be closer to $3.8MM housing units! Coupled with tumbling homebuilder confidence, confidence dropped by five points from 51 to 46 in May, we are likely poised which for further stagnation.

Without a significant spike in either new listings or new homes coming to market, we are likely to continue to see homes selling quickly, once listed, at or above the market value. As we can see from the latest FRED, home pricing are continuing an upward trajectory:

🥊Reality check - We do have a few bright spots, as we have seen a steady increase in homes being listed for sale, with 7 consecutive months of increases through the end of May, per Realtor.com. We have also seen increases in the amount of new build homes being completed, with a 15.4% increase YoY, which should give a momentary boost to new listings.

Lastly, the information from FRED also includes home sales from very competitive/pricy markets, which isn’t a true representation for all markets and regions. Specifically, the Southwest, Florida and Northwest have seen housing pricing fall which could make for some great buying opportunities in those regions.

Taking in all of the above, the elusive American Dream of homeownership still feels far away for far too many Americans. Due to this, many Americans are being forced into renting for longer than desired at ever increasing monthly amounts.

The Rise of the Renter Market

Is it better to Rent or Buy in the current market?

It is estimated that 65.8% of Americans own their home, while only 34.2% rent. However, this doesn’t tell the whole story as 70% of homeowners are 45 years or older, with only 10% of homeowners being younger than 35.When we look at renters, one-third of renters are younger than 35, with Millennials making up 42% of all renters in the country.

Taking this into mind, we are starting to paint a picture where high interest rates and housing prices are keeping younger Americans from owning homes since many homes are being occupied by older generations along with many Millennials and Gen Zers not having the assets in place to take the plunge into homeownership as first time home buyers.

💭 Consider this - for at least the short term, or until the housing market rebounds/corrects, we are likely to see many continuing to rent and push off homeownership. While renting can be a cheaper alternative to homeownership, with monthly renting costs averaging about $2,000 vs $2,400 for a mortgage (excluding insurance and taxes), it may start to become far less attractive once you factor in long-term costs:

Therefore, we believe it is very important to stay close to clients who are renting and continue to educate and help them plan for the next step towards homeownership. This will keep your client loyal, while also helping provide the necessary information for them to make educated purchases when conditions are right!

Conclusion

With interest rates and housing stocks continuing to be a thorn in the side of potential home buyers, we are likely to continue to see renters stay in place, while they wait out better market conditions. However, we believe that it's not only important to take advantage of becoming a renter-side agent but also taking this opportunity to make deep connections with your renting clients and becoming the education tool that can help them understand the cost-benefit of renting vs. homeownership while also becoming their go-to person for when they are ready to buy! Real Estate agents provide invaluable resources to their clients, so make sure you are staying close to them all, whether they are landlords, first-time home buyers, level-uppers or those renting until homeownership can become a reality!

Comments